Kanagawa Small and Medium Construction Association is an association of builders with offices in Kanagawa Prefecture, of which small and medium-sized builders and sole contractors are members.

Membership allows access to the following two associations.

- Kensetsu Rengou National Health Insurance Union, Kanagawa Branch

- SME Mirai Support (labour insurance clerical union)

In addition to this, various insurance and mutual aid schemes are available.

* ‘National Pension Fund’, ‘Construction Career Up System (CCUS)’, ‘Small Business Mutual Aid Plan’, etc.

Kensetsu Rengou National Health Insurance Union, Kanagawa Branch

Premiums determined by age group regardless of income!

National Health Insurance

If you join Kanagawa Small and Medium Construction Association, you are entitled to use the Construction National Health Insurance scheme. The co-payment at the counter of a medical institution etc. is 30% for both the individual and family. (Those who have not yet entered primary school pay 20% and those aged 70 and over, depending on their income, pay 20%).

In addition, the Construction National Health Insurance also provides insurance benefits such as injury and illness benefits and medical check-ups to help you in case of unexpected situations.

Anyone under the age of 75 working in the 30 construction industries can join, even if they live outside Kanagawa Prefecture.

*[Those who have been issued medical certificates for subsidised medical expenses by local authorities such as the medical subsidy for infants and children] As our health insurance association is authorised by Aichi Prefecture, those living outside Aichi Prefecture will be treated as outside the prefecture even if they visit a medical institution in their area of residence.

When visiting a medical institution, even if you present your medical card, it will not be applied at the counter, so you will have to pay the medical expenses (20% or 30%) once by presenting only your insurance card, and you will need to apply for the subsidy after the fact to your local municipality at a later date.

[One of the following is not eligible for membership].

Residents of Yamagata, Niigata, Nagano, Okayama, Yamaguchi and Nagasaki Prefectures.

Employers and employees of corporations such as joint-stock companies and limited liability companies.

Those who are employed by private establishments employing five or more people on a regular basis.

About the procedure

Contact the branch for deadlines and submission forms.

Insurance premiums

National health insurance premiums (monthly)

| Union member himself | Premiums |

|---|---|

| 19 years and under | 8,000 yen |

| 20 to 24 years of age | 10,000 yen |

| 25 to 29 years of age | 13,000 yen |

| 30 to 39 years of age | 17,000 yen |

| 40 to 49 years of age | 20,000 yen |

| 50 to 64 years of age | 22,700 yen |

| 65 to 74 years of age | 22,900 yen |

*April 2023-.

Family premiums (monthly) * Under 1 year olds are exempt from premiums.

| Your families | Premiums (per person) |

|---|---|

| 0 years old | 0 yen |

| 1 to 6 years of age | 5,400 yen |

| 7 to 18 years of age | 5,400 yen |

| 19 to 64 years of age | 6,400 yen |

| 65 to 74 years of age | 7,400 yen |

*April 2023-.

Long-term care insurance (monthly)

| Target group | Premiums (per person) |

|---|---|

| 40 to 64 years of age | 3,700 yen |

*April 2022-.

*Care insurance premium collection for those aged 65 and over will be transferred to your municipality.

Be a partner for your business establishment in a variety of ways!

Supporting management and protecting the livelihood and health of employers, employees and their families.

Labour insurance

The construction industry is the industry with the highest number of accidents involving work-related injuries.

As a labour insurance administration association authorised by the Minister of Health, Labour and Welfare, Kanagawa Small and Medium Construction Association undertakes everything from enrolment to premium payment and troublesome procedures in the event of accidents on your behalf.

Work-related injuries and illnesses are covered by workers’ compensation insurance

~ Be prepared for any eventuality ~

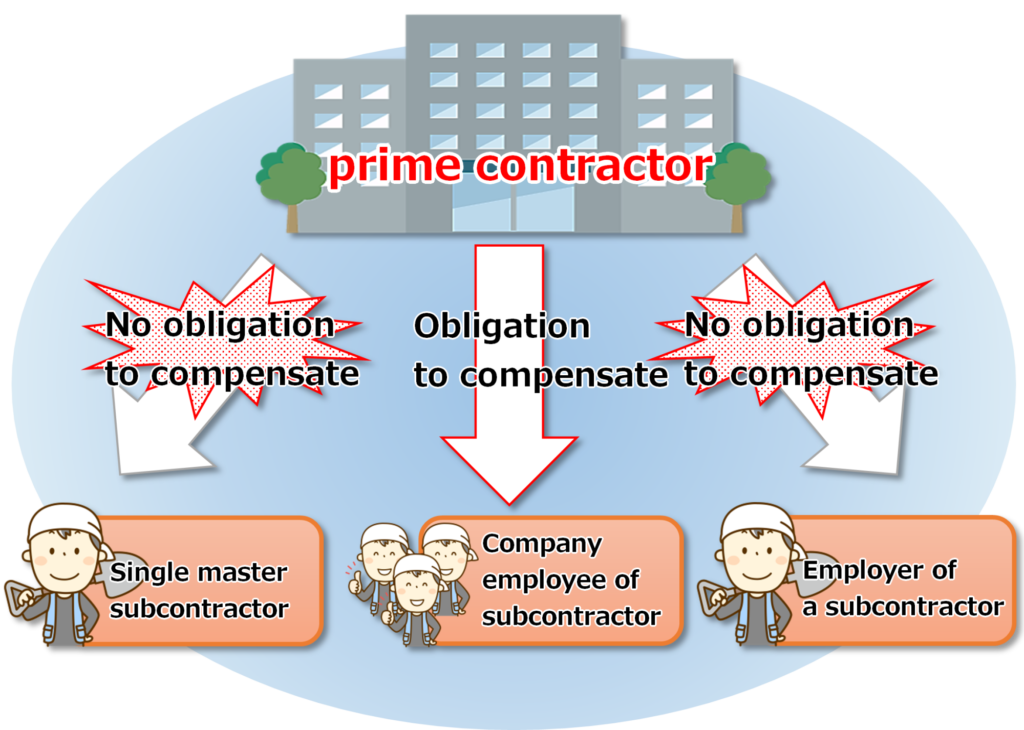

- Establishments employing even one worker are obliged to join the Workers’ Accident Compensation Insurance scheme.

-> Workers’ compensation at the workplace - Employers and lone workers are not covered by labour insurance unless they have special enrolment themselves.

If you are a member of the Kanagawa Small and Medium Sized Construction Association, you can apply for special enrolment.

-> Employer special enrolment or sole-parent workers’ compensation

- Workers’ accident insurance premiums at the workplace

| Annual prime contractor payment | Annual premiums |

|---|---|

| 1,000,000 yen | 2,760 yen |

| 5,000,000 yen | 13,800 yen |

| 10,000,000 yen | 27,600 yen |

| 20,000,000 yen | 55,200 yen |

| 30,000,000 yen | 82,800 yen |

* Premium rates differ depending on the type of industry. Please enquire.

* Calculation formula = prime contract amount x 23/100 x 15/1000

(Formula for existing building equipment construction industry)

* Office workers’ compensation is also available.

- Special enrolment for employers and single masters

| Basic benefit amount | Employer premiums | Single master premiums |

|---|---|---|

| From JPY 4,000~JPY 25,000 * Up to JPY 10,000 in increments of JPY 1,000. * Up to JPY 24,000 in increments of JPY 2,000. | Daily rate x 365 days x 12/1,000 (Existing building equipment construction industry) * Other industries on request | Regardless of the type of construction industry Daily rate x 365 days x 19/1000 |

| 4,000 yen | 17,520 yen | 26,280 yen |

| 5,000 yen | 27,375 yen | 32,850 yen |

| 8,000 yen | 35,040 yen | 52,560 yen |

| 10,000 yen | 43,800 yen | 65,700 yen |

| 12,000 yen | 52,560 yen | 78,840 yen |

| 16,000 yen | 70,080 yen | 105,120 yen |

Four major national compensations

Workers’ compensation

- Medical compensation: full compensation for medical expenses until the patient is cured.

- Compensation for absence from work: 80% of the average wage is compensated per day from the fourth day of absence.

- Disability compensation: pension or lump sum depending on the degree of disability.

- Survivors’ compensation: pensions, lump sums and funeral expenses are paid to survivors in the event of death.

Unemployment insurance if you lose your job

- The insurance is applicable to establishments that employ workers and provides benefits for a stable life and re-employment when an employee retires.

- Insurance premium = gross wages x 18.5/1000 (of which the worker pays 7/1000)

* As of April 2023. - Short-term employees with a “migrant worker’s certificate” are also eligible to join.

<<Labour insurance administration association, SME Mirai Support>>

Join the Workers’ Accident Compensation Insurance!

- Industrial accidents at work in the company : If you hire employees, make sure they join! Employers and family workers must also be “specially enrolled” if they are on site!

- Single-master industrial accident : Make sure you are covered by your single-master industrial accident, regardless of whether you are the main contractor or a subcontractor!

<<Outsourcing paperwork offers the following advantages>>

- The labour insurance paperwork, such as declaration and payment of labour insurance premiums, is handled on behalf of the employer, thereby reducing the administrative workload.

- Employers and family members who would not normally be able to join the labour insurance system can join it by entrusting the labour insurance administration association. (daily fee of between 4,000 yen and 25,000 yen).

Take out employment insurance!

- The insurance is applicable to establishments that employ workers and provides benefits for a stable life and re-employment when an employee retires.

- Insurance premium = gross wages x 18.5/1000 (of which the worker pays 7/1000)

* As of April 2023. - Short-term employees with a “migrant worker’s certificate” are also eligible to join.